How much is Google worth? Or Apple? Or your SME? One of the most crucial issues for any company is surely its financial valuation. It is essential that senior management and investors be able to obtain the most precise estimate of the company’s value if there is an acquisition or disposal, or if they are raising capital. Although the question may appear simple, providing a response is more complicated. And the various methods used to answer the question can lead to significant deviation in value. Corporate Finance professor Rémy Paliard proposes an effective new hybrid approach, which he presents to us here.

Which methods are usually employed to estimate the value of a company?

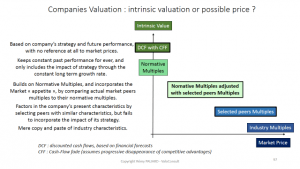

Analysts generally employ two main types of approaches to calculate a company’s financial value. The first type aims to determine an intrinsic value of the company, based on its strategy and on its individual characteristics and performance, irrespective of financial market fluctuations. The most commonly used method in this category is DCF, which values the company on the basis of the cash it will generate in the future while implementing its strategy. For mature companies, we can also approximate this intrinsic value by applying coefficients, which I will call “normative multiples”, to different variables such as turnover, operating income, net income or equity.

Conversely, analogical methods aim to determine a possible price, based on the prices observed for a sample of comparable companies whose shares are either publicly traded on a stock exchange or traded in over-the-counter transactions.

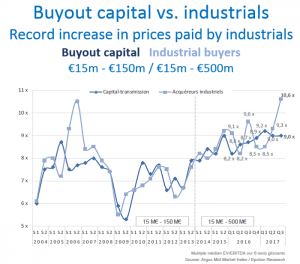

This analogical “Multiples” method is more and more often the only method used by investment banking and private equity experts, who contest the relevance of the DCF approach, considering it overly dependent on the hypotheses retained to determine the future cash flows. However, questions could also be raised regarding the Multiples approach, particularly if we consider the variations in the EBITDA multiple for example, which has doubled overtime [1]:

In short, the so-called Multiples method firstly involves selecting a sample of “peers”, in other words businesses deemed to be comparable to the target company that we are attempting to value. One of the most important comparability criteria is the business sector, with other criteria including profitability, growth profile and risk level. The enterprise value observed on the market for each peer-group company is then used to calculate various ratios, known as “multiples”.

These multiples are next applied to the relevant variables for the company being valued in order to obtain its enterprise value. Financial debts are then deducted, in order to obtain the value of its shares.

Unfortunately, even If peers have been carefully chosen, it is quite frequent that the range of possible prices obtained using this method proves much too wide – up to 30% or 50% – to be of any real use.

What contribution does your approach make?

My approach tightens the range of possible prices, fine-tuning the price estimate calculated using the Multiples method. I would describe this approach as “hybrid” because it takes into account the intrinsic characteristics of both the peer-group companies and the company that we are attempting to value by incorporating market conditions.

The idea is to determine the market “appetite” for companies in the industry of the company being valued, by comparing the peer-group company multiples observed on the market to the multiples we would expect these peers to have, given their intrinsic characteristics. By comparing the observed multiples to the normative multiples, we obtain an over-valuation, or under-valuation coefficient, which reflects the intensity of competition between investors or buyers purchasing the shares of companies in this industry, at that point in time.

We then determine the company’s value using its own normative multiples, and adjust this value by applying the over-valuation or under-valuation coefficient calculated for the peer-group companies.

The benefit of this approach is that we obtain a much tighter range of prices by eliminating the non-comparable elements of the peer-group companies used as a reference. Instilling a dose of intrinsic value in the “copy and paste” approach to pricing effectively helps to mitigate the limitations of the classical Multiples method.

This approach also has the merit of integrating the target company’s performance, and simultaneously of factoring in the range of possible prices derived from market conditions. Ultimately, it avoids the risk of an intrinsic valuation, obtained using DCF for example, being completely “disconnected” from reality.

The diagram below illustrates how this “hybrid” method is positioned, between the intrinsic valuation approach, based exclusively on the future cash flows generated by the company, and the determination of a possible price calculated solely on the basis of market industry multiples.

Practitioners will find this an effective tool for improving their estimation of possible prices: all that is required is a small time investment to obtain more detailed data on the peer-group companies.

[1] Latest edition of the ARGOS SODITIC EPSILON index, 3rd quarter 2017.

Professor in corporate finance, I have a PhD in Management Science. My expertise focuses on companies’ valuation, value creation management, financial diagnosis and risk management as well as forecast and business modeling. I train and help entrepreneurs and managers to use finance as a decision tool. I design the financial part of business plans and suggest the needed financial devices helping financing growth without loosing control.

More information on Rémy Paliard:

• His CV online

Further readings…

- Example of calculation illustrating the method and R. Paliard’s full article:

Lettre Trimestrielle de l’Association A3E (Association des Experts en Evaluation d’Entreprise), septembre 2017, pp 9-13.

Read letter online - For more details on the Multiples method:

UBS’s document on this method:

Read document online - To go one step further: Andreas Schreiner’s doctoral dissertation

Schreiner, A., 2007. Equity Valuation Using Multiples: An Empirical Investigation. The University of St.Gallen, Dissertation for Doctor of Business Administration.

Read dissertation online - Working Paper by Andreas Schreiner and Klaus Spremann

Schreiner, A., Spremann, K., 2007. Multiples and Their Valuation Accuracy in European Equity Markets. Working Paper.

Read working paper online

Recent Comments